Annually the 402(b) Regulator Asset Protection Structure Custodian is excluded from reporting the value of your tax deferred account. YOU file to the IRS Form 8938 “Zero Value” and you report the actual value on the FBAR Form. This process validates transparency with the IRS. The Custodian is specifically an excluded FFI by FATCA.

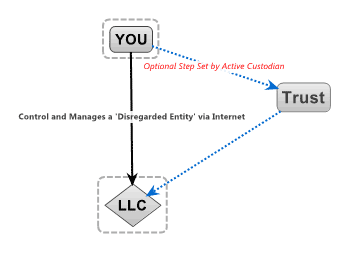

You control and manage the LLC via the internet where you access your investment account with the active custodian. A Trust can also be in place to manage the LLC, however this is an optional step for your own purpose.

Under IRS rules, the LLC is considered a ‘disregarded entity’ because, in this example, you are filing as an individual.

To download the 402(b) Regulator Asset Protection Structure mind map Click Here

[box]The best return on offshore investment is achieved in a legal structure, with an investors program in accordance to the policies, procedure and process of statutory law, regulatory reporting and intergovernmental agreements. Our strategy uses pension law and retirement plan regulations.[/box]

There is no off-the-shelf product that achieves the exempt from reporting foreign financial institution and excluded beneficiary account that is described more fully in our white paper (see: Offshore Expert’s Guide).

[box type=”note”]Privacy and Secrecy can be structured in an Exempt Hong Kong Occupational Retirement Scheme Ordinance (ORSO) Financial Account to be Formally Recognized in the PRC, U.K., E.U., OECD, USA and throughout Asia.[/box]

This excluded beneficiary account is where you keep your secret about your money, investments and assets.

Leave a Reply